REI Pro Guard Tax & Legal Seminars

#2 – Mastering Real Estate Closings

1 DVD – 4 hours. Intermediate-to-Advanced level

You make money at real estate closings, they say. Do you realize that you can also lose money at closings?

How so? In our experience, if we take three random closing statements, one out of three will include hidden accounting mistakes that literally cost you thousands of dollars.

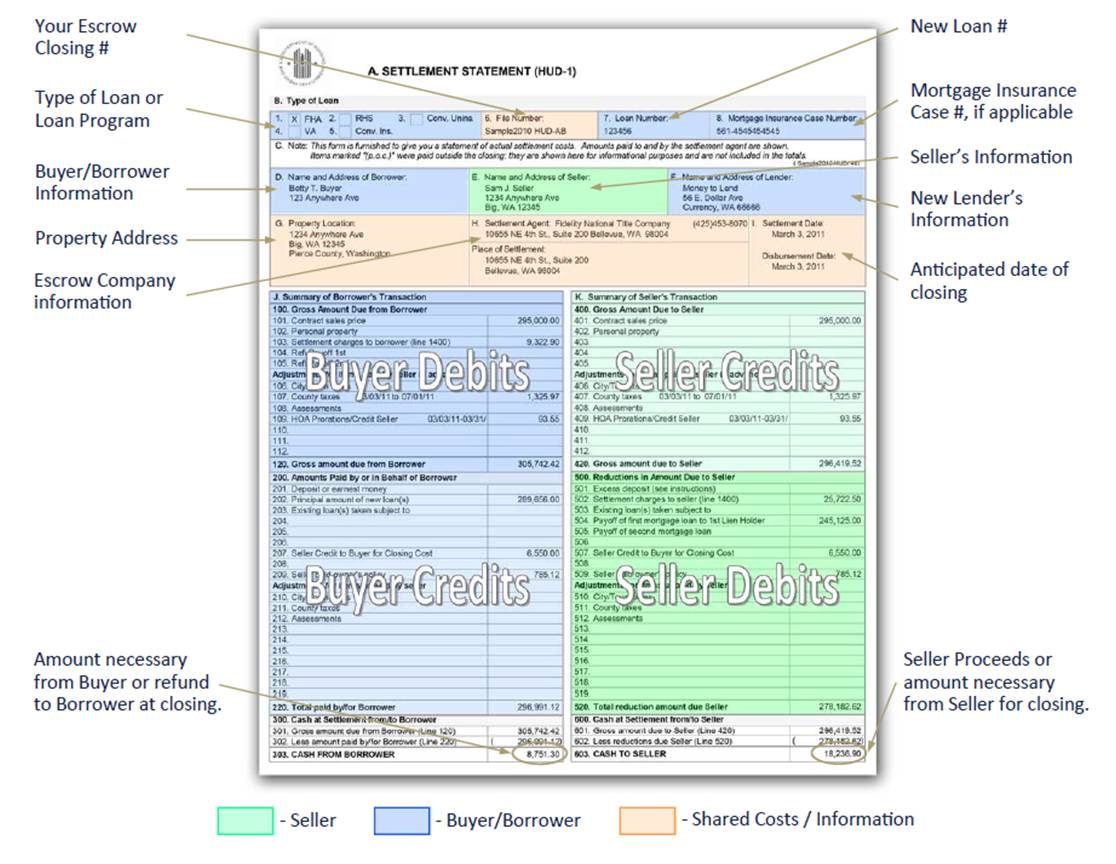

The document you always review at closing is the one with dollar figures: the old HUD-1 statement or the new Closing Disclosure documents that replaced HUD-1 statements for conventionally financed purchases.

And what numbers do you usually look at? The two key numbers:

- the sales price at the top and

- cash you bring to or receive at the closing

Of course, these two numbers are crucial and deserve your attention. But what about the other couple dozens of numbers – how important they really are?

Well, the answer depends on how much you value your money. Here are some real-life examples from our clients:

- J.W. – charged twice for the same insurance premium. Cost of the error: $1,366.

- R.R. – overlooked repair escrow, not reimbursed after rehab. Cost of the error: $6,200.

- B.J. – missed credit for the prepaid property taxes. Cost of the error: $3,108.

- H.A. – hard money fees improperly charged on both ends. Cost of the error: $4,209.

- I.Z. – overlooked rent pro-ration and deposits on a 24-unit. Cost of error: $21,551.

Which of these $$$ errors you would not care about if they were on your HUD-1s?

Are you sure that your HUDs did not have any of these or many other costly mistakes?

Such mistakes are extremely costly but are also preventable. In this unique class, we study these confusing closing statements line-by-line, so they are no longer a mystery.

The best part is that we are looking at the real life examples from actual deals done by your investor peers. Learn from other people’s mistakes, and save thousands!

Needs to be required of all investors before doing a hard money loan.

T.K.

Closing statements, however, are only a few pages out of the 2-inch-thick stack of paperwork that you’re given to sign. What about all the other mysteriously lengthy documents that we don’t want to read? Really, who has time to read them all?

This leaves you with 3 options:

- Rely on your attorney to read these papers and protect you

- Learn what to look for among these countless pages

- Keep your fingers crossed that nothing bad will happen

As we will show in this class, the last one is NOT an option: ignoring or not understanding the various legally binding documents that you sign at closings can put your entire deal at risk or get you and your business sued.

“Lots of useful information. Good examples that expose most common traps and areas of mistakes.”

Anna Spadaccini

Stop wasting your money and risking losing your deals to closing mistakes! Invest in this 4-hour advanced training and learn from two experts with a combined 40 years of real estate experience.

Michael Plaks, EA* is a “Black Belt” in real estate taxation. He owns one of the top 3 tax firms in Houston since 1996, serving exclusively real estate investors. Michael is an award-winning speaker, best-selling author and the ultimate expert in IRS taxation for realty investors.

Steven Newsom has been practicing law and assisting real estate investors with their legal issues since 1997. Besides a J.D. degree, Steve has a B.S. degree in engineering and an MBA. An active investor himself, he focuses his general civil practice on real estate, business and contract law. Steven is a best-selling author and teaches at Rice University.

*EA – Enrolled Agent, Federally licensed to represent clients before the IRS, the highest IRS designation.

Your $397 investment can be repaid at your very first closing! And then it will keep paying back.

BETTER VALUE: All 4 “REI Pro Guard” seminars for the price of three: $1,197 – one seminar FREE!

BEST VALUE: Entire library – all 11 seminars for the price of seven: $2,497 – FOUR seminars FREE!