Custom tools for RE Investors: let’s get organized!

We know that you hate bookkeeping and taxes. Our job is to make your job easier. This is why we created these tools specially for you – a Real Estate Investor. You cannot find anything like that elsewhere – promise! If you want to minimize your taxes and your stress – you need our tools. And some of them are even free!

Tax preparation: once-a-year chore

- List of income tax documents – bring these to us for tax preparation

- RE investor’s Tax Organizer – complete set of custom-designed worksheets

Bookkeeping: day-to-day records

- Minimum Bookkeeping Requirements for RE investors – a one-page summary

- RE investor’s Introduction to Bookkeeping guide – a concise overview of all you need to know

- RE investor’s MoneySaver logbook – simple and effective paper-based system

- RE investor’s custom Chart of Accounts – advanced breakdown of recommended accounts

List of income tax documents

If you hire us to prepare your taxes, we will need your documents. What documents, you ask? Just a copy of your W-2 is not enough. Every receipt from Home Depot is way too much. We prepared a detailed list of what we need – available at no cost. Some examples are:

- All forms that include “1099” in their names

- Complete annual statements from investment firms

- Forms 1098 from lenders

- HUD-1 (aka “closing” or “settlement”) statements

- Contracts for “kitchen table” closings

- Last two years of tax returns

- and more – so request the complete list

How do you benefit?

- Simple: no documents – no tax return

Cost and ordering

- FREE

- Download it here

RE Investor’s Tax Organizer

Whether you prepare your taxes yourself or hire a professional like me – you need to organize your numbers. This means sorting expenses by categories, adding them up, and arranging them in some order. If you use accounting software (and use it correctly) – most of the job will be done by computer. The rest of us need worksheets. This is exactly what we designed: a comprehensive list of worksheets, including an extensive list specifically for Real Estate investors like you. No more confusion: you will know exactly what numbers are needed.

Our tax organizer has been very popular among Houston investors since 2004 – clients or not.

Look at these sample fragments to get an idea of how easy yet comprehensive this tool is:

- Communication, travel and entertainment expenses

- Home office expenses

- Insurance and property taxes for a rental property

- Sale of a rental property

The organizer comes as a downloadable set of PDF documents. They can be printed out and completed by hand the old-fashioned way – or you can complete them electronically using the free Adobe Acrobat Reader software.

How do you benefit?

- You will know what data is necessary

- You will not be collecting unnecessary data

- You will save time and avoid back-n-forth

- And – you will pay the least tax possible!

Minimum bookkeeping requirements for RE investors

This is a single-page document. One page only! It takes 5 minutes to read, but it can save you hours if not days of wor, not to mention thousands of dollars.

- Separation of business and personal money

- Recording of business expenses

- Bookkeeping for rental properties

- Bookkeeping for flip properties

- Busines use of automobiles

How do you benefit?

- Your bookkeeper will know what to do

- Your books will make sense to your accountant

- You will have less stress

- You will save money

Cost and ordering

- FREE

- Download it here

Bookkeeping rules for RE investors

It is a classic catch-22: most investors do not understand bookkeeping, and most bookkeepers do not understand real estate business. “Aggravating” is a mild way to put it. This unique 5-page document is designed as a bridge between an investor and a bookkeeper. If you keep your books yourself – this guide will help you avoid common mistakes. If you hire a bookkeeper – this will be her desktop reference. This document has more practical information on its 5 pages than you can find in 500-page books. Topics covered:

- Difference between rental and non-rental business

- List of expense categories for RE businesses

- The importance of “placed in service” date

- Refinancing and selling

- Construction and rehabs

- Bookkeeping for automobile expenses

- and much more …

How do you benefit?

- Your bookkeeper will know what to do

- Your books will make sense to your accountant

- You will have less stress

- You will save money

RE investor’s MoneySaver logbook

If you know me, you know that I prefer to keep things simple – see my “Ten Commandments of Great Bookkeeping” article. Software is powerful and “professional”, but it is often confusing and frustrating. Not to mention that it is not as handy as a notepad. If you prefer the old-fashioned (but still very practical!) “pen & paper” bookkeeping – you cannot find a better tool than my MoneySaver logbook. Why? Because it is designed specifically for Real Estate Investors. It is a perfect companion to our Tax Organizer, it is professionally printed, and it comes in two compatible sizes:

- Full-size – 8.5″ by 11″ pages, book-style – regular “letter” size for your briefcase.

- Compact – 3″ by 8.5″ perforated pages. Perfect for your purse or glove compartment.

There are three main parts in this awesome organizer, plus bonuses:

-

- Business expenses log, per property

-

- Auto mileage log, as required by the IRS

-

- Time log, to prove “RE professional” status

- Summary worksheets to calculate annual totals for taxes

- List of suggested expense categories with explanations and tips

How do you benefit?

- You will not forget to deduct what you spent. It adds up quickly!

- You will know your accurate mileage for maximum deductions

- You will have a bullet-proof defense against the IRS challenge

- You will save a lot of time and money at tax time

RE investor’s Custom Chart of Accounts

What is a Chart of Accounts?

This is a fancy term used in accounting systems like QuickBooks. It simply means a list of categories, grouped in a sensible way. For example, this could be a very basic Chart of Accounts for landlords:

- Income

- Rent

- Late fees

- Other

- Expenses

- Mortgage

- Taxes

- Insurance

- Repairs

- Other

Why do investors need our custom Chart of Accounts?

Because the list above, like most other lists, is very primitive and will not be enough for tax preparation. For example, repairs need to be further broken down into maintenance, repairs and improvements. Several other categories need to be separated, such as management, commissions, utilities and advertising, among others. Business overhead expenses are missing from this chart. Also missing are accounts to record purchases and sales of properties. Instead of Mortgage category, we need two categories for two kinds of interest. And so on.

Our carefully designed custom Chart of Accounts includes

- Landlords chart: 40 accounts

- Dealers/Flippers/Rehabbers/Builders chart: 40 accounts

- Combined chart: 60 accounts

Is this Chart of Accounts designed for QuickBooks?

No! It is simply a well-designed comprehensive list that you can receive in WordPad, Excel and/or PDF format.

It can certainly be implemented in QuickBooks, but it works with any accounting system. “Any system” includes the old-fashioned pen-and-paper system and your homemade Excel or Google Sheets tables.

Sample fragments from Tax Organizer & Deduction Finder

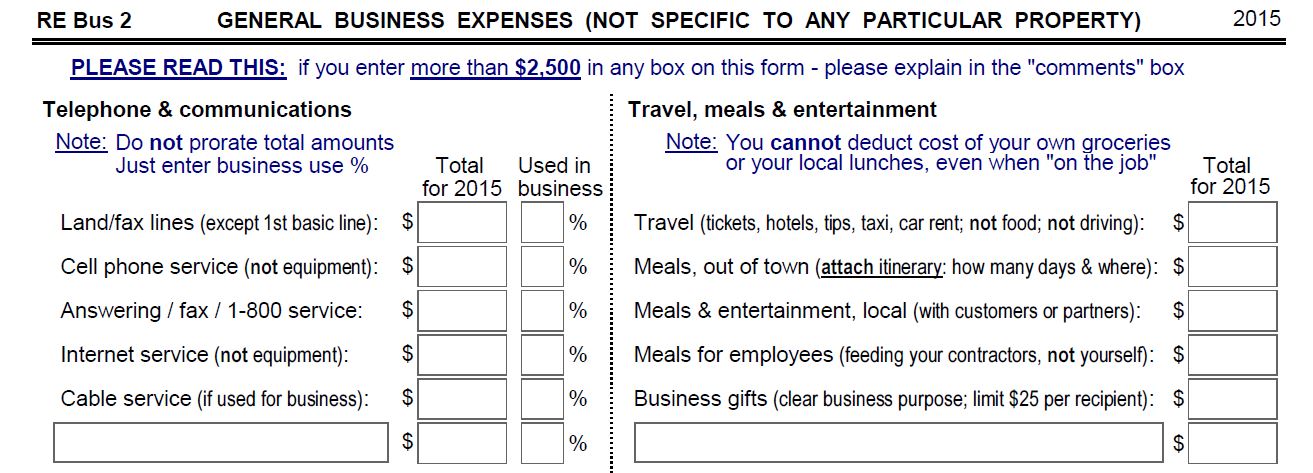

Communication, travel and entertainment expenses

Did you remember to deduct a portion of your cell phone bill? Did you know that meals for your crews should be stated separately because they are 100% deductible, as opposed to 50% deduction for most business meals? Have you considered a per-diem method for out-of-town business travel? This is why we ask all those questions!

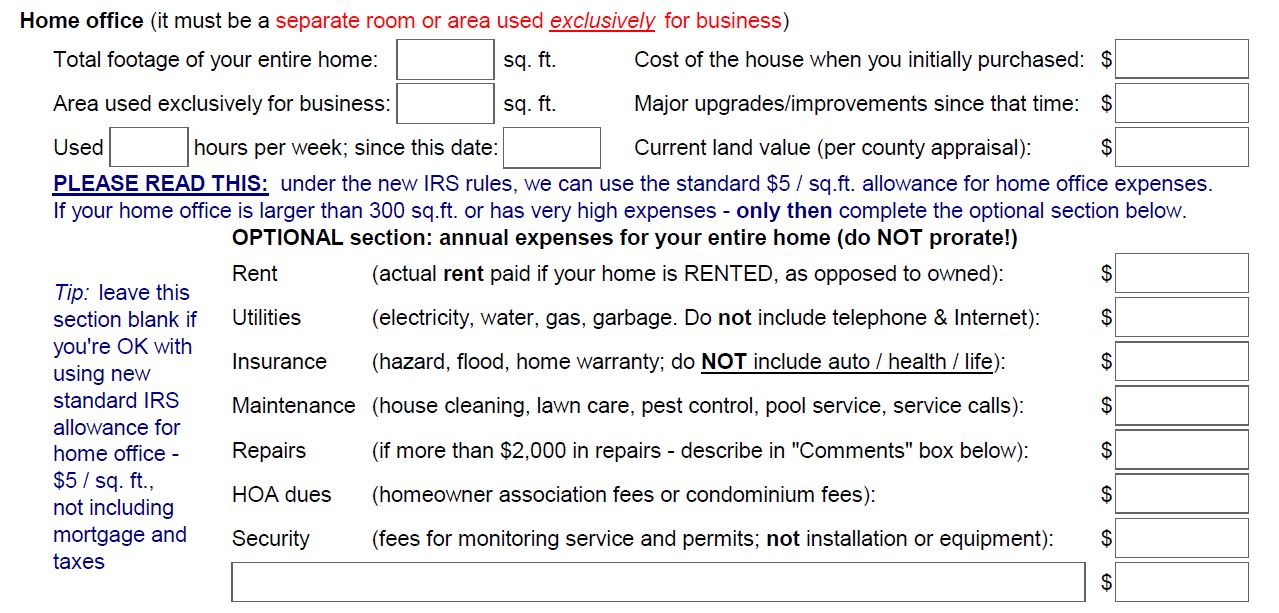

Home office expenses

Home office deduction is very often misunderstood. I wrote on my blog about this deduction. I also created a special section on the tax organizer that makes sure you will not miss this important deduction and calculate it correctly.

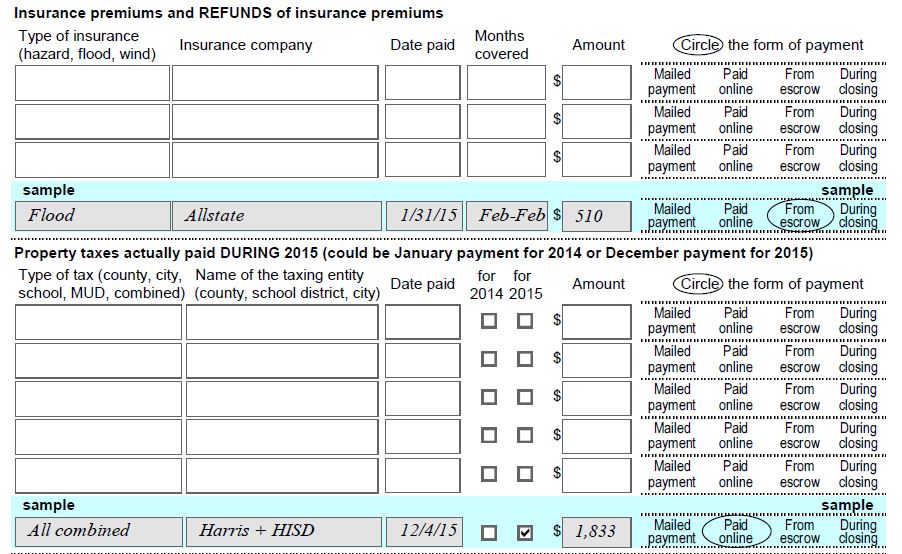

Insurance and property taxes for a rental property

A very common mistake is to deduct property taxes paid in January 2016 as a 2015 expense. Yes, it is taxes for 2015, but what matters for the IRS is the actual payment date. So taxes paid in January 2016 should go on 2016 tax return, not on 2015. If you use our organizer, you will avoid this common mistake – and many other mistakes.

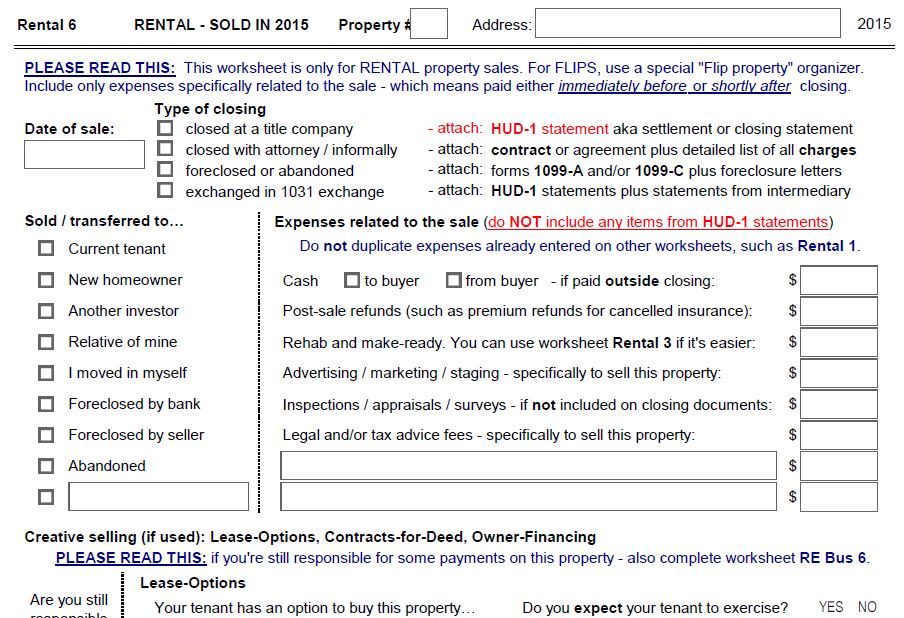

Sale of a rental property

Had pre-sale expenses? We have a special place to enter them. Sold it with owner-financing? We ask the right questions. Got foreclosed? We know how to report it. This is the difference between a generic accountant and a REI specialist.

Sample fragments from Bookkeeping Organizer & Logbook

Ongoing business expenses

Let’s keep it simple, folks. Here is all the information that is required: when, to whom, for what, and how much. If you look at the example below, this is exactly what is being recorded in the expense log. There are some optional, but very helpful, features: expenses are kept separate by property; you can record the method of payment; and you can assign tax-reporting categories to each expense. For your convenience, categories are listed at the bottom of each page.

Business mileage log

In order to claim a deduction for driving, you must have a mileage log. You are not required to send it to the IRS unless they ask for it. So why not be prepared? Besides, once you start counting, you will realize that you drve more than you thought -I promise!

Time log

There may be good reasons to keep track of your time. One is to explain your husband why you are never home. Another is to explain the IRS why you would qualify for a very beneficial status called “real estate professional.” For this status, you do not need to have a realtor license, but you do need to show how much time you spend in your business. Look, I even included cartoons to make your recordkeeping as easy as possible!

Michael,

Thank you for those kind words and that generous introduction at the RICH Club this past weekend. You are very good to me, thank you.

Kevin

It’s easy when it’s the truth. You’re the best, Kevin.